BY Maxence Bizien, ALFA | May 1, 2023

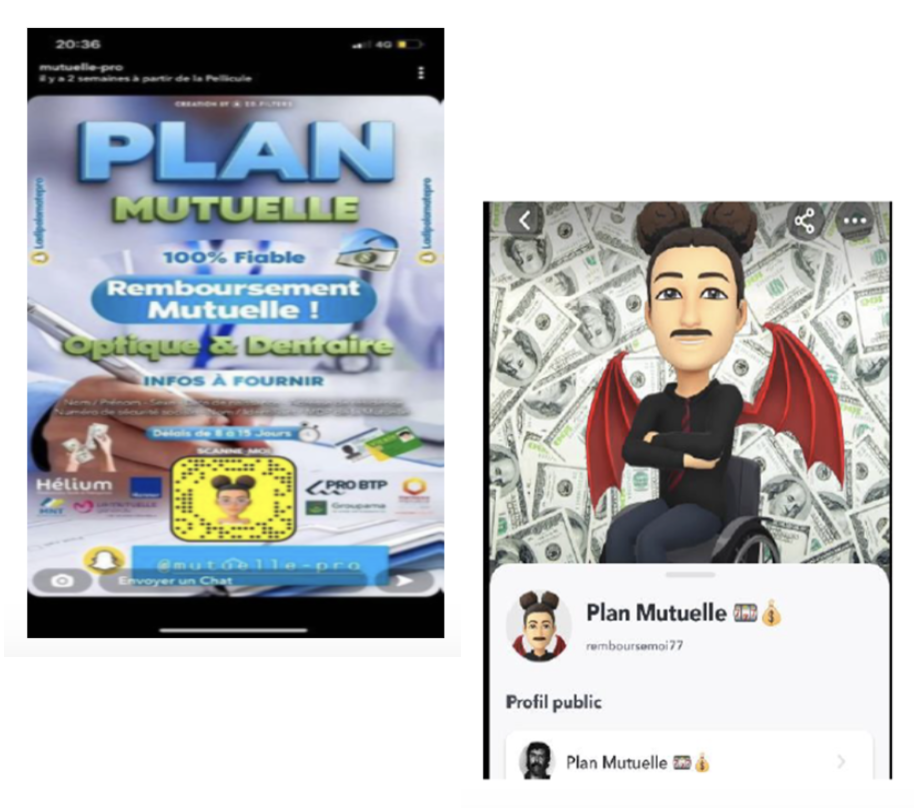

Insurance fraud has been on the rise in France, and social networks have become one of the main facilitators of this type of criminal activity. Fraudsters are using social media platforms like Facebook and Snapchat to advertise their services to potential clients, primarily individuals looking to earn some extra money through a “good deal.”

These fraudsters use various social networks to advertise and communicate with their clients, and some even use Telegram to sell kits for making fake invoices to other fraudsters. They typically ask for personal information, including identity card, personal address, and login credentials for insurance websites, and they manage the relationship with the insurance company directly. Scammers know when refunds are made, the deal is usually to share the profits equally between the fraudster and the client.

Fake invoices are typically generated for car window breakage or dental implants, with the average cost of a windshield replacement around 900€ and a dental implant costing approximately 3500€. To enhance their incomes, fraudsters even encourage their clients to take out several extra insurance policies or mutuals. Unfortunately, the insurance industry is relatively helpless against this type of fraud, and fraudsters often go undetected.

To combat this issue, the Agency for the Fight Against Insurance Fraud (ALFA) has been collecting fake invoices received by its members to find similarities and avoid overpayment. This has helped insurance companies file complaints and reduce the occurrence of fraudulent claims. However, the justice system’s pace often slows the process of identifying and prosecuting fraudsters, making it challenging to combat this type of fraud effectively.

ALFA recommends that its members systematically write an email to the compliance department of different social media companies to close the accounts of fraudsters. However, these compliance departments rarely respond or take action, making it challenging to combat this type of fraud effectively.

In response to this growing issue, ALFA, supported by France Assureurs (French Insurance Body), has decided to publicize the problem of insurance fraud facilitated by social networks. The topic has interested the media and after a written article, the executive director of ALFA was interviewed on the two main French television channels.

The goal is to educate the public that the cost of this type of fraud is not just borne by the insurance companies but also by the community of insured individuals. Fraud is punishable by 5 years imprisonment, 375,000€ fine and the prohibition or confiscation of certain rights. Furthermore, those who participate in insurance fraud give their personal data to professional fraudsters who may be using it for other illegal activities.

If a participant in the scheme does not continue the deal, the fraudster may threaten the victim with violence, a very real threat when they know your home address, or take out fraudulent loans in your name, knowing your financial information. Thus, it is critical to raise awareness about this issue and take appropriate measures to protect oneself from being a victim of insurance fraud.

The rise of insurance fraud facilitated by social networks poses significant challenges for law enforcement and regulators. On one hand, social media platforms have revolutionized the way we communicate and conduct business, opening up new opportunities for individuals and companies alike. However, these same platforms also create opportunities for fraudsters to operate under the radar, using private forums in platforms like Snapchat and Telegram to evade detection.

This presents a complex regulatory challenge. On the one hand, we need to protect the freedom and privacy of social media users while preventing criminal activity like insurance fraud from occurring. Striking the right balance between these competing interests is difficult, and there is no easy solution to this problem.

The hardest part of preventing insurance fraud over social media is that fraudsters often operate in private forums, making it difficult to detect fraud in real-time. As a result, insurance companies and agencies like ALFA need to rely on after-the-fact analysis to identify fraudulent activities, which can delay the detection and prosecution of fraudsters.

In summary, while the rise of insurance fraud facilitated by social networks in France is a growing concern, there are no easy solutions to this problem. Regulators and law enforcement agencies need to find ways to balance the need for privacy and freedom with the need to prevent criminal activity. Moreover, at the insurance sector level, we need to find better ways to detect and prevent fraud proactively rather than just relying on after-the-fact analysis: by raising awareness about the risks of insurance fraud and encouraging individuals to take steps to protect themselves, we can help reduce the incidence of fraud and create a safer, more secure online environment.

The author

Maxence started his career in 2002 as assistant in the security and information protection division for a french defense and security company. In 2003, he was urban security consultant for the prefecture of Southern Corsica. He joined a facility management group in 2004 to initiate the concept of « outsourced Security Manager » for sensitive customers. During 11 years within the Insurer Generali France, he successively held the position of Head of Security and Risk and Compliance manager leading the insurance counter fraud strategy and the special investigation unit. Since March 2018, he’s been the Executive Director of ALFA, the french professional non-for-profit organization fighting against insurance fraud. ALFA is directly linked with the French Insurance Federation (France Assureurs).