By Steve Adams | August 31, 2023

What is a VIN and How Insurers Can Use Them

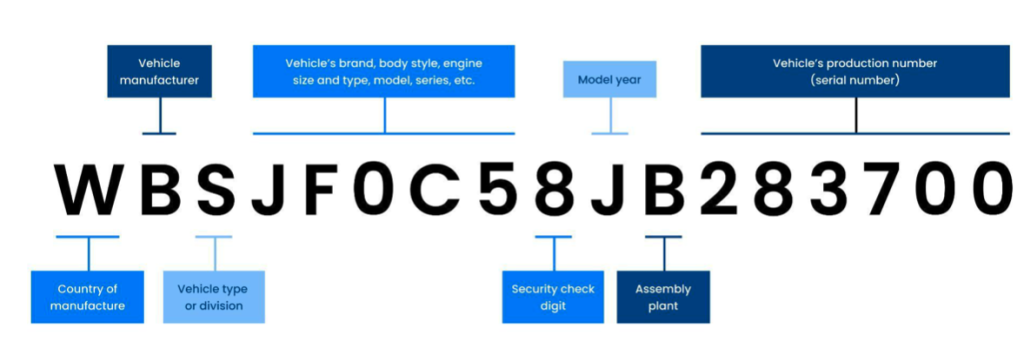

A VIN, or Vehicle Identification Number1, is a unique 17-digit alphanumeric code found on every car, truck, and motorcycle from 1981 to the present. This code is structured to provide the world identification number, the vehicle’s description, and the vehicle’s identifiers. A VIN is distinct from a VRM, or Vehicle Registration Mark, which is the industry name for the license plate2 that is displayed on every vehicle in the world. Generally an alphanumeric identification, VRMs are only unique to vehicles within a state or country and may be repeated on multiple vehicles around the world. When conducting investigations into vehicles of interest, accessing VINs ensures that investigators have a truly unique number associated only with their target vehicles, removing confusion and false positive issues related to VRMs.

VINs can play a critical role in preventing automotive insurance fraud. Insurance investigators and claims handlers can research VINs to verify the vehicle’s make, model, and year when a policy is issued. This information can ensure that the correct vehicle is covered and that the policyholder is not attempting to fraudulently insure another vehicle. Insurance carriers may additionally research a VIN when a claimant is involved in an auto collision to confirm the actual vehicle involved and disrupt fraudulent claims.

In the U.S., insurance carriers and law enforcement can access data on VINs through a number of channels:

National Insurance Crime Bureau: This database stores VINs and HINs (boat hull identification numbers) from flooded vehicles and boats.

National Motor Vehicle Title Information System (NMVTIS): This federal database records comprehensive information on a vehicle’s title, brand, and odometer history. Through the NMVTIS, insurers can quickly uncover red flags, as this system provides detail on whether cars are reported stolen or declared total losses via junk and salvage yard operators and insurance companies.

Insurance Services Office (ISO) Claim Search: This claims database identifies if a vehicle has been involved in any previous insurance claims.

Carfax and AutoCheck: These commercial databases provide vehicle history reports covering previously reported accidents, repairs, and service records.

State DMVs: DMV databases provide current and historic ownership records and any liens for vehicles registered locally.

How Fraudsters Misuse VINs

Criminals too have discovered that they can leverage VINs for their benefit. Fraudsters may replace or alter a VIN in order to mislead potential victims or law enforcement in a number of ways:

– VIN Cloning aka Re-Vinning: When the VIN of a legitimate vehicle is added to a stolen vehicle or one rebuilt from salvaged parts in order to deceive the buyer.

– VIN Altering aka VIN Switching: Where some of the characters on the VIN on an illicit vehicle are tampered with to match a different vehicle that portrays an alternate identity, concealing the actual history of the vehicle. Vehicles with altered VINs are often used to commit other crimes, such as robberies and smuggling.

– Salvage Fraud aka Title Washing: Occurs when a fraudster buys a vehicle previously declared a write-off, replaces damaged parts, and obtains a new title and VIN to sell the vehicle for more than its true market value. Salvage fraud is commonly seen on vehicles damaged by storm flooding, as some states require a “salvage only” classification on titles of flooded vehicles when damage amounts to more than 75% of the car’s value.

– Fraudulent Insurance Claims: Involves a fraudster submitting false claims for theft, accidents, or damage, using multiple legitimate VINs to support their fraudulent claims.

By changing a VIN, criminals alter a vehicle’s history and “fingerprint” to make it appear as though it is another vehicle. Fraudsters alter VINs in various ways, including counterfeit VIN plates, sanding down an original VIN and stamping a new one, or using acid to remove the original VIN and impressing a new one in its place. An alternative but less common technique entails replacing the dashboard of a stolen vehicle with one from an identical make and model sourced from a scrapped vehicle. As fraudsters frequently replicate an existing VIN for a vehicle they do not actually have access to, VIN fraud also can involve generating counterfeit vehicle registration documents and titles that match the new vehicle identity in an attempt to convey legitimacy.

Insurance fraud rings misuse VINs in the various illicit ways outlined above to deceive consumers and insurance carriers with the goal of obtaining significant financial value to the tune of many millions of dollars each year. To combat these crimes, insurance investigators should seek to employ advanced technology and tools, such as automated OSINT solutions, to identify those involved and disrupt them.

How Carriers Can Detect Fraud Using VINs

Insurance fraud involving VIN manipulation is growing, with car cloning in particular increasing at an exceptional rate3. Insurance carriers are also seeking new methods to curtail these trends. A potential tailwind working in the carriers’ favor, fraud activity continues to migrate online4, and the same applies to VIN-related schemes. With this activity moving online, new doors open for investigators to rely on OSINT (open-source intelligence) tools and techniques to combat auto insurance fraud driven through VIN misuse.

Skopenow’s team of in-house investigation and fraud specialists has worked with insurance carriers to identify avenues for investigators to pursue when investigating VIN misuse.

As an initial step, investigators can leverage free commercial databases to research VINs. Investigators can search a VIN through FAXVIN by replacing the word “VINNO” with any vehicle’s VIN after the equals sign in the following URL: https://www.faxvin.com/order/decoder?vin=VINNO. Alternatively, investigators can search on vehiclehistory.com by replacing the word “VINNO” with a vehicle’s VIN after the final forward slash in the following URL: https://www.vehiclehistory.com/vin-report/VINNO. By conducting one of these simple searches, investigators can easily access the information for a vehicle registered to a specific VIN to determine whether key details match up. If a vehicle is the wrong make and model for the VIN, this immediately raises red flags. While fraudsters often use the VIN of a similar, corresponding make and model, insurers may still be able to detect less obvious fraud indicators like mismatching color, model year, or transmission type.

Another avenue for investigating VIN misuse includes searching across online marketplaces for listings that include a relevant VIN. When vehicles are sold online on platforms like Facebook and Craigslist, vendors often include the VIN. Online marketplaces may be used by fraudsters for several VIN-related frauds. They may use online sales platforms to sell vehicles that have cloned or altered VINs, as well as salvage fraud vehicles. They may even create fake listings for stolen vehicles in an attempt to steal money from potential buyers, ensuring there is no trace linked to them through vehicle registration documents.

After investigators have identified potential fraudulent listings on online marketplaces, they can use link analysis to build a clearer intelligence picture of those involved in the broader scheme. When investigators identify a fraudulent listing, they can analyze the seller’s social media profiles, online marketplace accounts, and public records to capture and analyze their digital records. Navigating their social profiles, they can harvest lists of associates in friends and followers lists. Analyzing these lists against other, known fraudsters enables insurance carriers to identify common names that they can use to connect involved sellers with co-conspirators, accomplices, or other individuals involved in the same scheme.

An additional route for detecting fraud using VINs is by analyzing related publicly available data. In the US, vehicle owners often share their personal information alongside a VIN when dealing with businesses, such as auto repair garages, and agree for this information to be shared. This dataset can be exploited to surface common data points that connect parties, businesses, and locations to further support the creation of link analysis charts.

In some cases, fraudsters will use an alias or stolen credentials to create seller accounts. This may prevent investigators from linking criminals to these accounts. However, criminals often make mistakes that reveal helpful clues, such as failing to change a vanity name/username from their real name or adding real associates as friends. It is always worth checking for any hidden details like these that can crack a case wide open.

Automating OSINT Investigations into VINs

With over one million cars stolen in the US in 20225 and a further 12-15 million vehicles scrapped6, the opportunity and impact related to VIN cloning, VIN altering, and salvage fraud are immense. It’s difficult to pinpoint exactly how many vehicles on the road have been cloned or had their VINs altered, but the number is likely to be in the millions, which is estimated to cost insurers millions of dollars in claims each year.

Given the scale, it’s unrealistic to expect insurance investigators to manually investigate every VIN misuse-enabled fraud. Investigators simply don’t have enough time, especially considering other responsibilities, to manually research every VIN, search for them across every online marketplace, and then research identified vendors. That process alone would take more than an hour per vehicle. To tackle this monumental task, insurance carriers can equip their investigations teams with automated OSINT solutions.

The right automated OSINT solution can enable investigators to quickly and efficiently query numerous online sales platforms for fraudulent vehicles through the VIN itself or a vendor’s PII. Employing advanced algorithms, automated solutions can quickly scan these online marketplaces, identify potential fraudulent listings, and provide investigators with a comprehensive report on each listing.

When a suspicious vendor is flagged, an investigator can use an automated OSINT solution to conduct more due diligence on them. An automated people and business search tool can find relevant and actionable intelligence to inform decision-making from across social media, consumer records, business records, web articles, court records, and more. When these automated tools incorporate purpose-built models for identifying fraud and threat indicators across social media and the open web, investigators can also rely on AI and machine learning to conduct image matching and analysis, natural language processing, and behavioral analytics to identify case-relevant, risk-based behaviors across posted text, photos, and videos. This process enables investors to cut down the time spent per case significantly, boosting capacity in the number of cases that an SIU team can take on. In addition, automated people search tools for OSINT can also help investigators to identify fraud schemes that involve fraudsters staging accidents with vehicles with cloned or altered VINS to claim insurance payouts.

With a detailed understanding of the key players, investigators can employ automated OSINT solutions to connect the dots between fraudsters by discovering the common data points that connect fraud rings. A link analysis chart historically took investigators days to build and involved many manual steps. Today, automated solutions can streamline this process, so they take just a few minutes. Many SIU teams are currently unable to generate any link analysis charts due to the need for training and a lack of available resources. With the power of an automated solution, creating link analysis charts is within the grasp of any insurance investigations team.

In conclusion, VIN-enabled auto insurance fraud remains a growing problem that costs insurance carriers substantial sums each year. To address this pressing issue, investigators can employ OSINT to research VINs, find illicit vehicles for sale, research vendors, and discover links to organized fraud rings. While these were once time-consuming processes that many SIU could not handle on their own, carriers now have the ability to implement advanced automation technology to equip their investigators with the tools they need to identify and track down fraudsters at scale. Automated OSINT solutions like Skopenow are here to help and support this important mission. Learn more at skopenow.com.

About the author: Steve Adams (steve@skopenow.com) is a criminal intelligence specialist and subject matter expert in internet investigations. As the Product Marketing Manager at Skopenow, Steve leverages his background in investigations to promote the value of the company’s solutions, showing how they can streamline internet investigations. Leading OSINT training webinars and speaking at conferences in the US and UK, Steve frequently dives deep into how to unlock the power of OSINT to live audiences. He holds a Law & Sociology degree from Warwick University.

Endnotes

1. What is a vehicle identification number (VIN)?, AutoCheck, 2015, https://www.autocheck.com/vehiclehistory/vin-basics

2. U.S. Government License Plates, United States General Services Administration, 2022, https://www.gsa.gov/policy-regulations/policy/vehicle-management-policy/us-government-license-plates

3. Car cloning: London sees 857% rise amid national vehicle crimewave, heycar, 2022, https://heycar.co.uk/guides/car-cloning

4. Criminals Exploit Covid-19 As Fraud Moves Increasingly Online, UK Finance, 2020, https://www.ukfinance.org.uk/press/press-releases/criminals-exploit-covid-19-fraud-moves-increasingly-online

5. The number of cars stolen in the U.S. surpassed 1M in 2022, PropertyCausualty360, 2022, https://www.propertycasualty360.com/2023/03/09/the-number-of-cars-stolen-in-the-u-s-surpassed-1m-in-2022/

6. Vehicle recycling, Wikipedia, 2022, https://en.wikipedia.org/wiki/Vehicle_recycling