The Coalition is the nation’s leader in conducting research to measure the multiple important aspects of insurance fraud. Our research helps decision-makers and consumers better understand the extent of insurance fraud, its root causes, and how to better combat this crime.

COVID-19 Insurance Fraud Impact (2021)

Insurer SIU Benchmarking Study (2020)

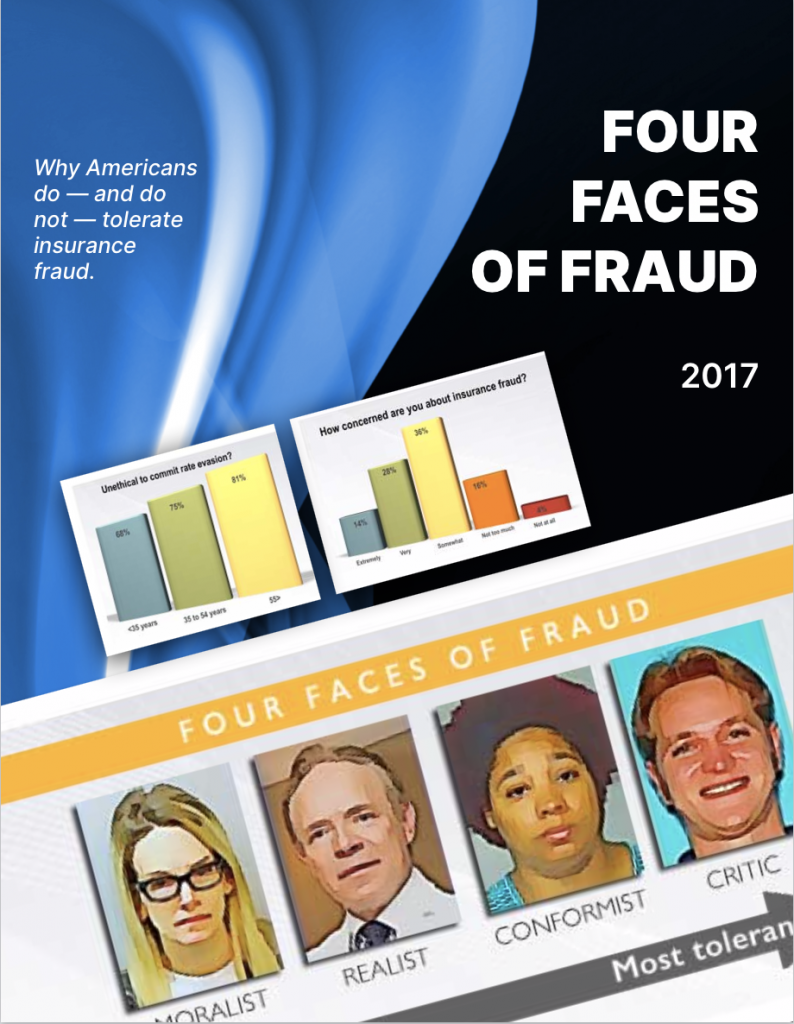

Four Faces:

Consumer attitudes toward insurance fraud (2017)

By The Numbers: Fraud Statistics

The Coalition partners with leading fellow anti-fraud organizations and academic institutions to continually provide important research data. Proposals for future research projects may be submitted to Matthew J. Smith, Esq. the Coalition’s Executive Director.