Consumer attitude study: Americans concerned about fraud, yet ethics mixed

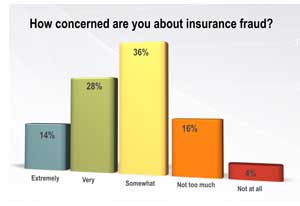

Nearly four of five adult Americans say they’re concerned about insurance fraud to varying degrees, says Four Faces of Insurance Fraud, the Coalition’s 2017 national survey of consumer attitudes. The survey of 2,733 consumers builds on Four Faces studies in 1997 and 2007.

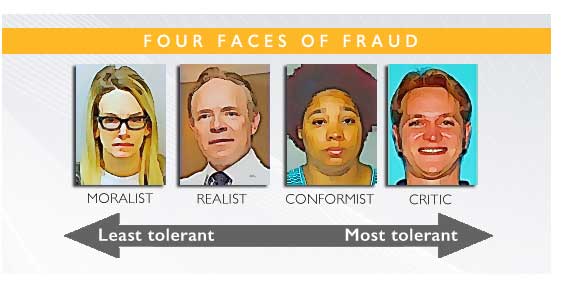

The study also places Americans into four groups based on their tolerance of insurance fraud:

• Moralists. Have little tolerance for insurance fraud and view the issue as one of fundamental honesty.

• Realists. Insurance fraud will always be there, even it is wrong. While they may not support committing fraud, it is a fact of life in the world of insurance.

• Conformists. Accept that fraud occurs, and may be easily tempted to join in.

• Critics. The critic is glad to see insurers fleeced. They welcome taking money from insurers, even via fraud.

Category findings

To the positive, the Critics group declined in size from 26% to 11% from 2007. While the Critics still are too numerous, a 15% drop suggests that public-awareness efforts to dissuade Americans from this crime are showing progress.

On the other end of the spectrum, however, Moralists who do not tolerate this crime continued to decrease from both prior studies. Squeezed in the middle are Realists and Conformists. They recorded sharp increases over prior studies.

Overall findings

Despite the drop in general consumer concern about insurance fraud, Americans overall show increasing tolerance for specific unethical behavior:

• 78% percent say they are concerned about insurance fraud

• 88% say it’s unethical to misrepresent an incident to obtain payment for an uncovered loss, compared to 93% in 1997.

• 84% say submitting an inflated claim is unethical, compared to 91% in 1997.

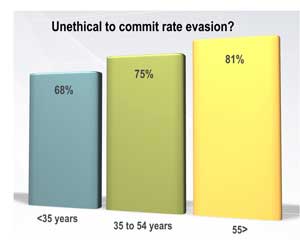

Older Americans are less tolerant than younger consumers:

• 81% of Americans over age 55 say premium evasion is unethical, compared to 68% of Americans under 35 years.

How people justify insurance fraud:

• Premiums are too high (70%).

• Insurer profits are too high (63%).

• Consumers want a fair return on the premiums they’ve paid (52%).

• Everybody does it (49%)

Analysis

The rise of Millennials has been America’s largest demographic shift between 2007 and 2017. Millennials now outnumber all other generations in the workforce. Our 2017 findings, in turn, point to the major impact Millennials will have on insurance fraud. They are more accepting of lying and dishonesty than their Baby Boomer elders.

Add in a widesrpread generational perception that big corporations are uncaring, and that CEO salaries unfairly dwarf the income of everyday workers. Pair that with the Coalition findings that many consumers belief fraud is committed in part in response to high perceived insurer profits and premiums. Thus younger Americans clearly will have a large impact on fraud for years to come.

Fraud fighters must ensure our consumer-awareness messages resonate with a younger and more diverse generation. We encourage the anti-fraud community to consider the implications of Four Faces on anti-fraud efforts as we unite to develop anti-fraud strategies that meet the evolving challenges of today’s consumer attitudes and behaviors.